2026 Open Enrollment

Benefits for a bright future

STABILITY. FLEXIBILITY. VALUE.

Welcome to 2026 Open Enrollment

In 2026, Barnes renews our commitment to supporting your health, wellbeing, and financial security with comprehensive benefits. We’re proud that we’re able to once again absorb the majority of rising health care costs and keep your medical premiums stable.* As you choose benefits that support your personal needs and goals — now and in the future — know that we’re here to support you every step of the way.

November 3 – 14, 2025

Benefitsolver.com

Open Enrollment (OE)

This is a chance to assess your current benefits, think about your needs and goals for the year ahead, and choose benefits that fit.

Make sure to consider any planned life events for you or your covered dependents, like getting married or having a baby. Learn about Life Events here.

2026 enrollment is passive*

That means if you don’t enroll, your current benefits will continue in 2026, subject to any required premium adjustments or vendor changes.

*Note: You must complete the enrollment process in order to do any of the following for 2026:

-

Enroll in the Healthcare FSA, Limited Purpose FSA or Dependent Care FSA

-

Change your HSA contributions to maximize the new IRS limits

What to know if you’re hired during Open Enrollment

Individuals hired during the Open Enrollment period must enroll twice. You will be prompted to first enroll for your 2025 benefits, and then you will need to enroll a second time for your 2026 benefits.

Option to receive a medical waiver credit

If you have medical coverage elsewhere, you may opt out of coverage through Barnes and receive a $600 credit per year (provided in equal installments on a per-pay-period basis). BarnesWorx and part-time employees are not eligible for the medical waiver credit.

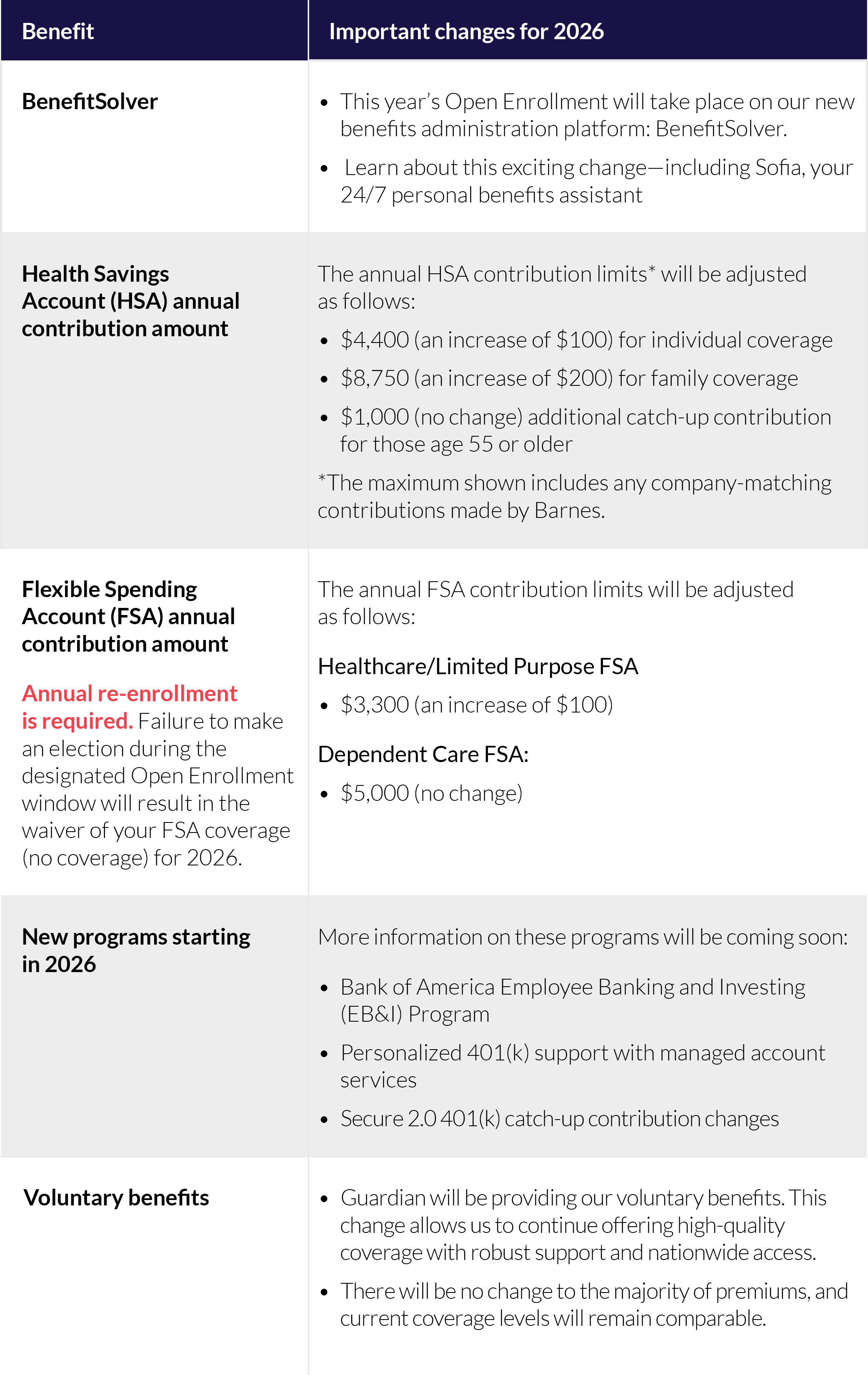

This year’s Open Enrollment will take place on our new benefits administration platform, BenefitSolver. BenefitSolver simplifies enrollment with a user-friendly interface, comprehensive resources, and mobile app accessibility.

BenefitSolver provides tailored assistance with Sofia, your 24/7 personal benefits assistant. Chat with Sofia in the MyChoice® benefits app and benefitsolver.com.

How to get started

Register and log in

- Visit benefitsolver.com and click the Register button to get started. The case-sensitive company key is barnes.

- Create your user name and password, verify your personal information and answer a few security questions.

- Log in using your new user name and password.

Questions? Ask Sofia

Whether you need help with your enrollment or have questions about your benefits, you can chat with Sofia, your 24/7 personal benefits assistant. Find Sofia in the MyChoice® benefits app and benefitsolver.com.

If Sofia can’t answer your questions, she will point you in the right direction for answers.

Sofia speaks over 20 languages, and can answer questions regarding 400,000 benefits topics, including:

- Coverage questions

- Plan comparisons

- Enrollment deadlines

- Dependent coverage

- ID cards

- And many more

Visit this site year-round to learn more about your benefits, find plan information, and access tools to improve your health.

How can I talk to someone?

To get live help with enrollment and benefits, call the benefit service center at 1-877-435-0260 Monday through Friday from 8:30 AM to 5:30 PM ET.

Don't forget to download the MyChoice® benefits app

Manage and access all your benefits information on the go.

Click Access the App at benefitsolver.com to get started, or scan the QR code to download the app on your device.

Here’s a quick summary of what’s changing for 2026. Please take a moment to review the updates before making your Open Enrollment selections.

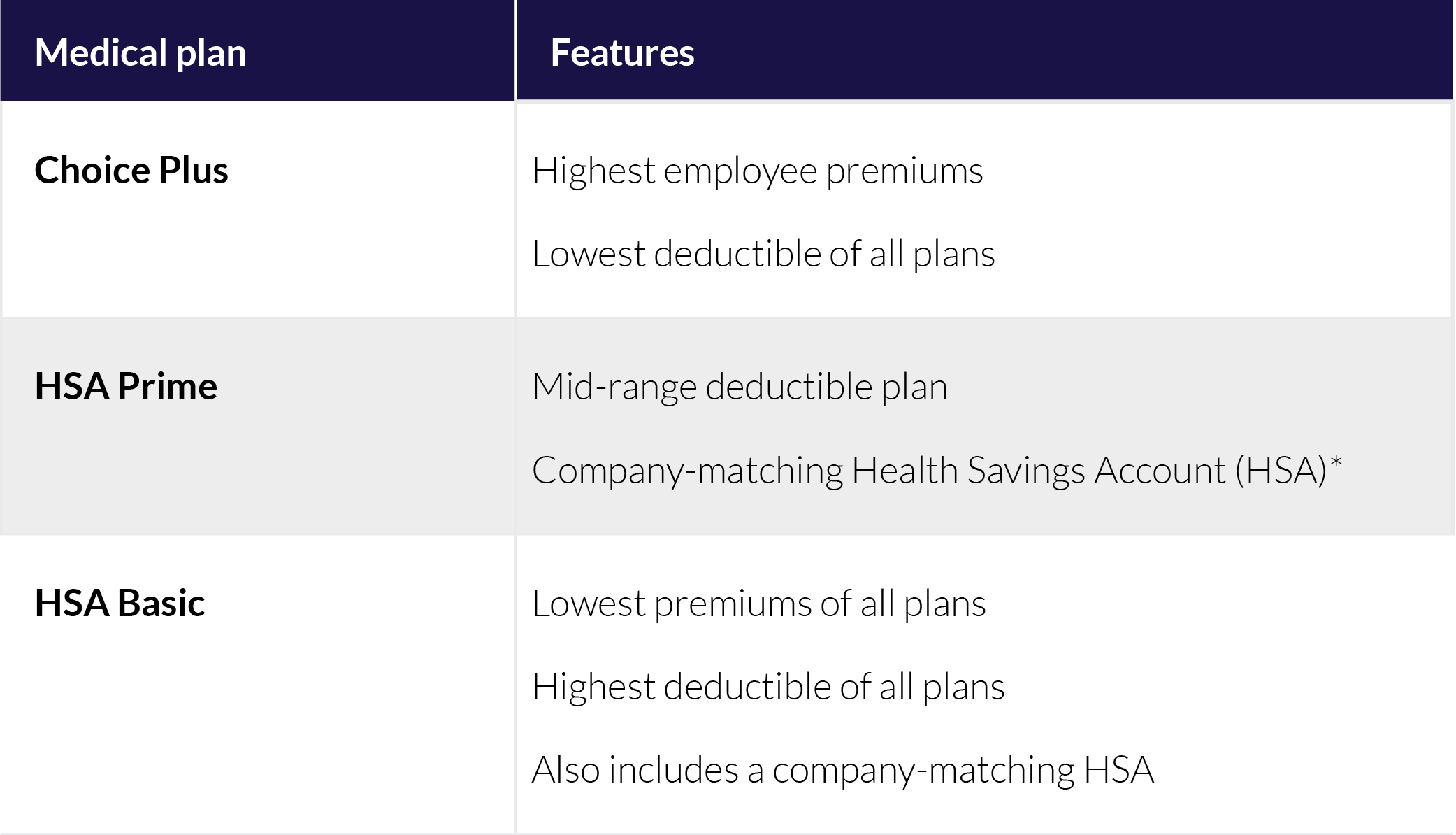

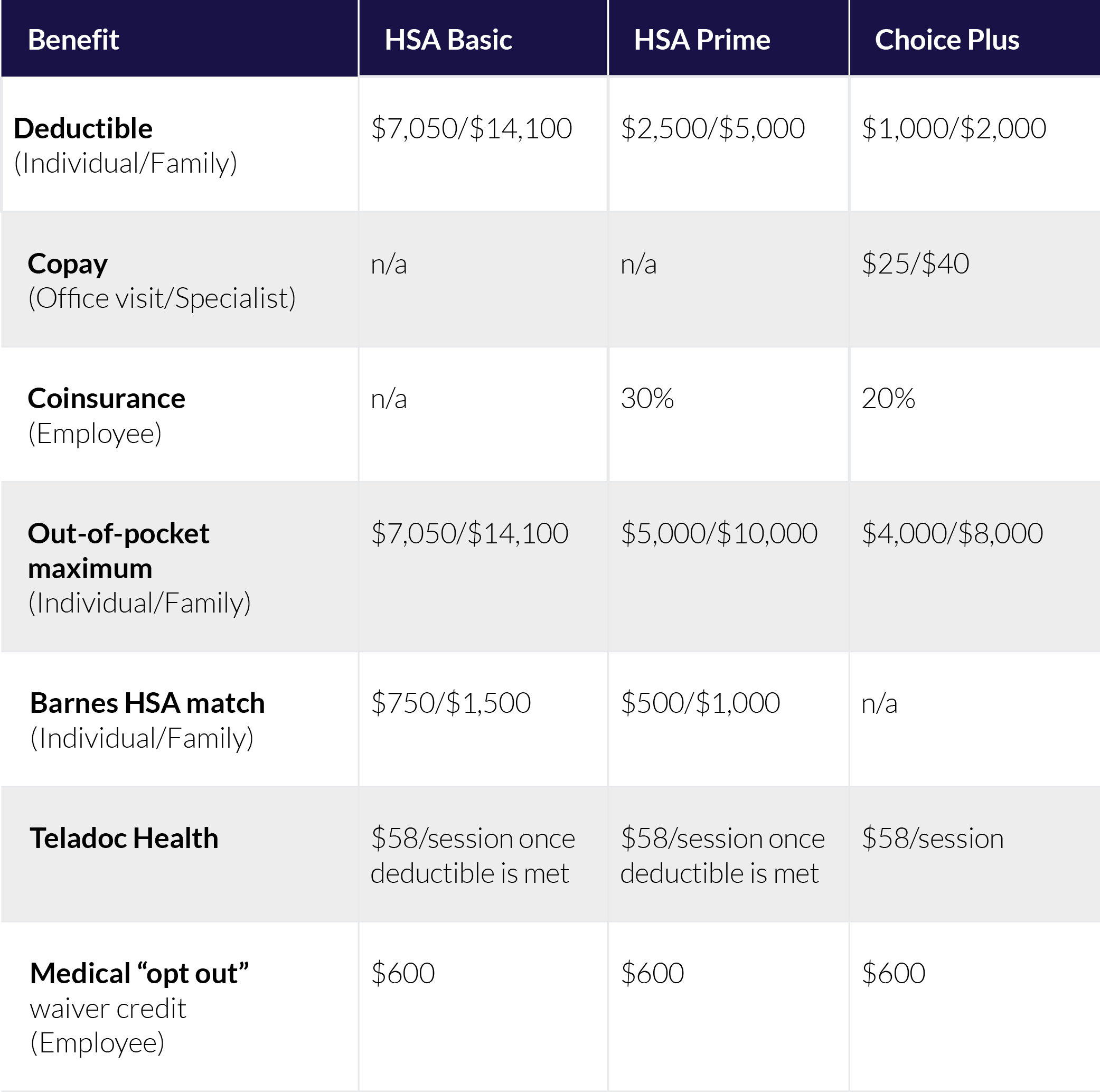

We’re happy to report that Barnes will continue to offer the same three medical plans with integrated prescription drug coverage in 2026.

*For more information on company HSA matching contributions, see the “What are my HSA and FSA options?” section.

Medical Plans at a Glance

Medical Plans Summary of Benefits and Coverage (SBC)

For more details about what’s covered under each medical plan, please refer to the Summary of Benefits and Coverage (SBC).

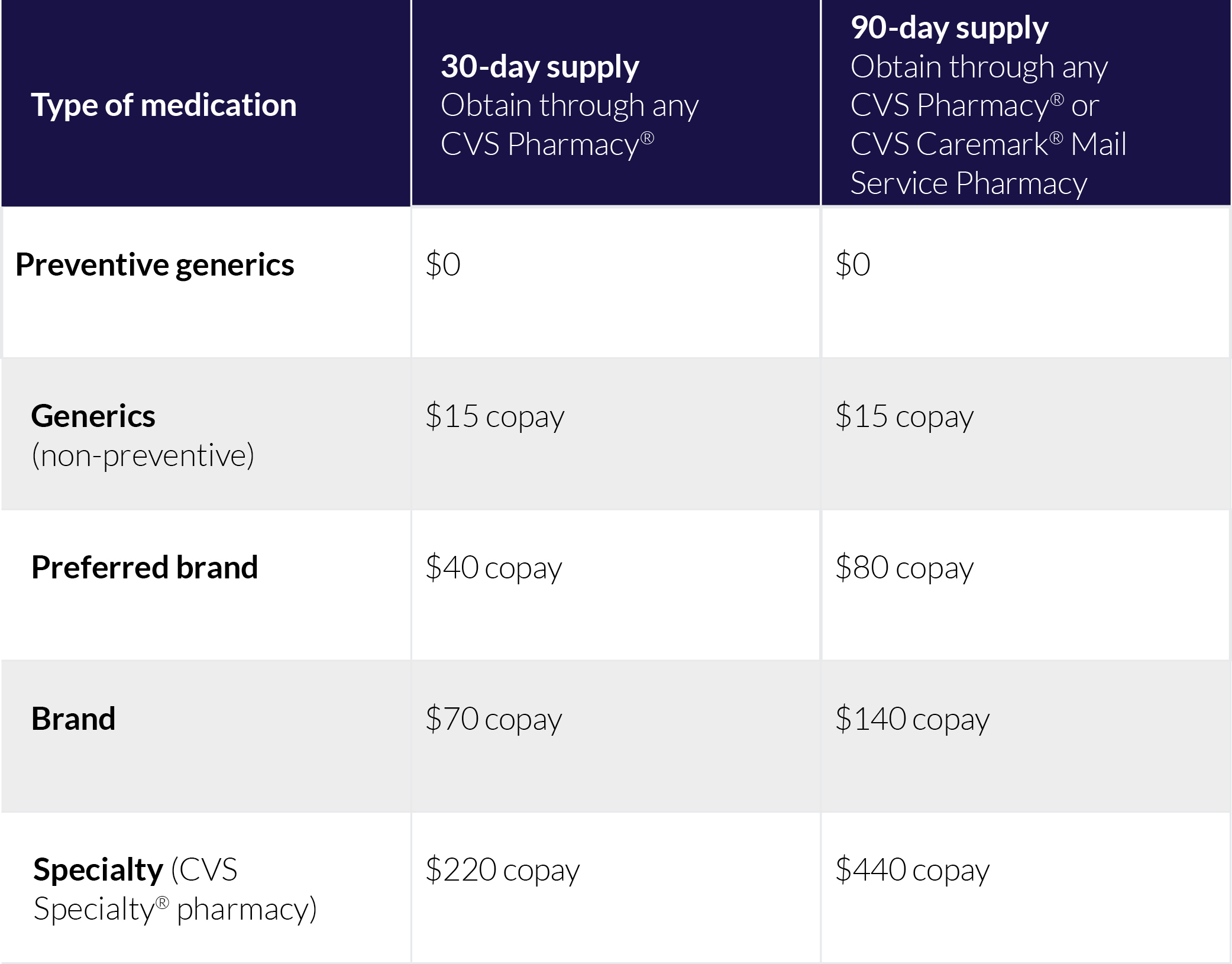

All plans have integrated drug coverage that covers the same medications, including free generic IRS-approved preventive medications. Please refer to the Summary Plan Description (SPD) or the plan documents for complete details on the prescription drug coverage.

Health Savings Accounts (HSAs)

An HSA is a powerful financial tool that you can pair with a Barnes high-deductible health plan (HDHP) to help reduce your medical expenses now and into the future.

HSAs are a smart way to manage your health care costs and build your long-term savings and financial wellbeing. That’s why Barnes matches your contributions, dollar for dollar, up to specified maximum, based on the plan and level of coverage you choose.

Contributions for 2026: The IRS maximum contribution limit has increased to $4,400 for an individual and $8,750 for a family.* ** ***

Barnes Group Matching Contributions

HSA Basic

- Individual: $750

- Family: $1,500

HSA Prime

- Individual: $500

- Family: $1,000

*Your contributions plus Barnes’ matching contributions count toward these IRS limits.

**Employees age 55 or over can contribute an additional $1,000 in catch-up contributions.

***Employees age 65 or over who are enrolled in Medicare are ineligible to make HSA contributions.

Flexible Spending Accounts (FSAs)

An FSA allows you to set aside a certain amount from your paycheck before taxes are withheld. Then you can use the money tax-free to pay for eligible out-of-pocket health care and/or dependent care expenses.

Contributions for 2026: The annual contribution limit for Healthcare and Limited Purpose FSAs will increase to $3,300 in 2026.

New Administrator for 2026: MyChoice Accounts is replacing WEX as the FSA administrator for Barnes employees beginning in 2026. As the FSA accounts are year to year, this should be a seamless transition for you. If you have a current WEX account, more information will be shared later this year about how to handle any remaining funds at the end of 2025.

Remember: You must re-enroll in your FSA each year if you want to participate.

We've taken steps for 2026 to keep your voluntary health benefits affordable.

To honor this commitment to you, we’ve transitioned supplemental Accident, Critical Illness and Hospital Indemnity insurance plans from Aetna to Guardian. This change keeps voluntary benefits affordable for you and provides a more integrated and stronger vendor experience. There are no changes to the majority of current premium rates, and current coverage levels will remain comparable.

The Vision plan will also transition to Guardian, while continuing to utilize the VSP network of providers you are familiar with today.

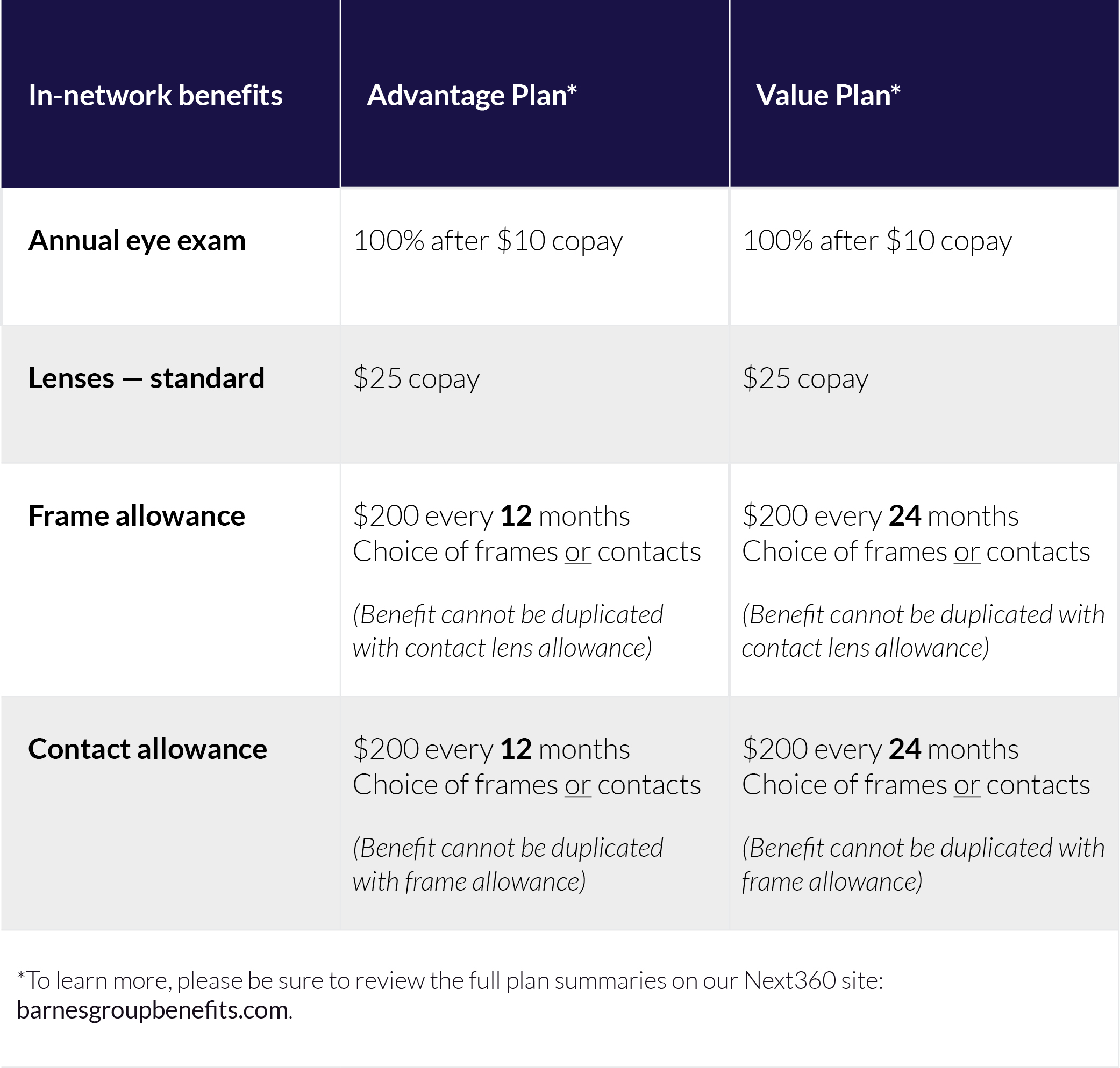

Vision

Vision insurance helps cover the cost of routine eye care, including exams, glasses, and contact lenses. You’ll have access to a large national network of vision providers through VSP, and the plan offers savings on eyewear, contacts and lens enhancements like anti-glare or progressive lenses.

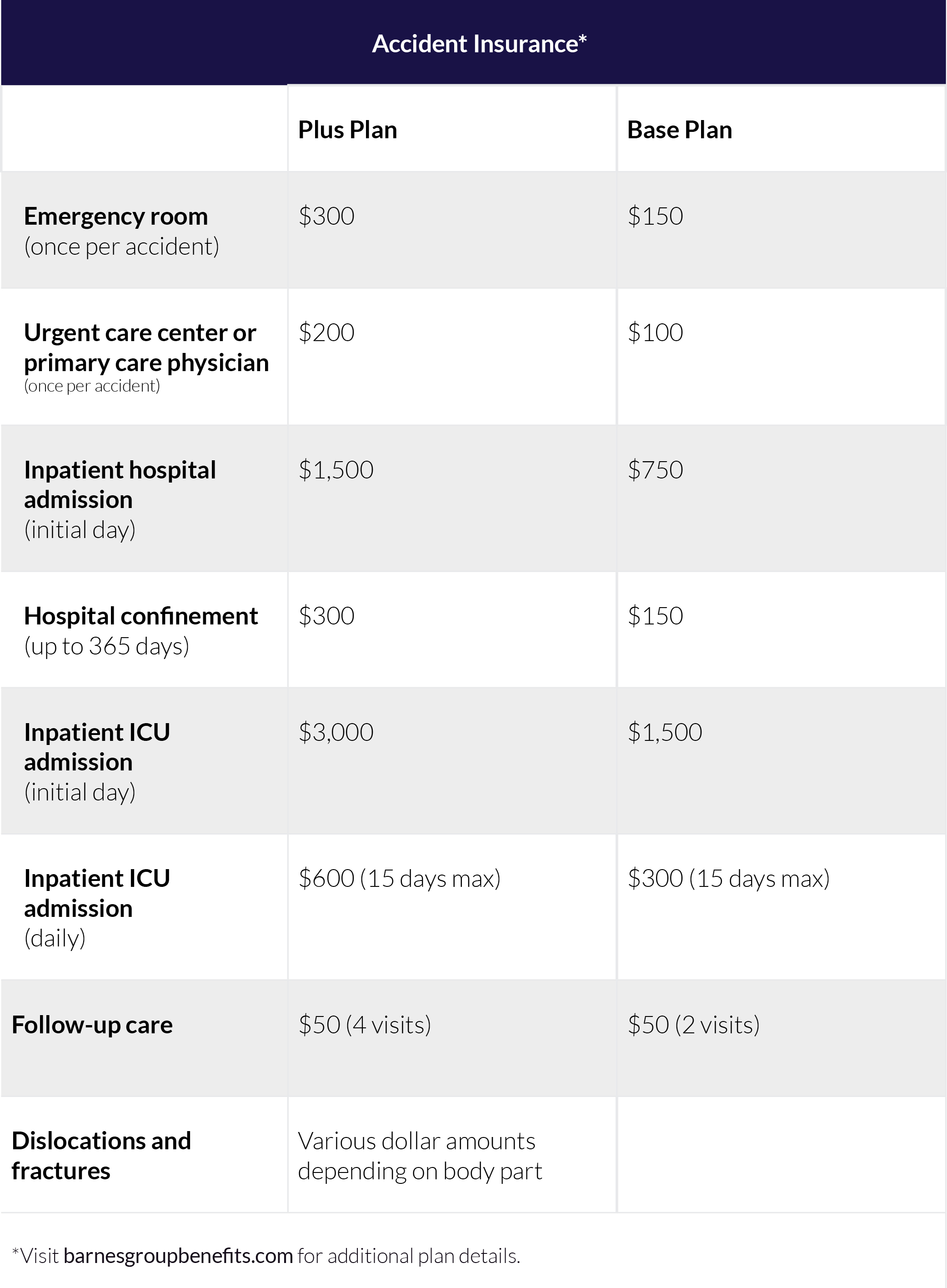

Accident insurance

Medical plans cover care for an injury but not unexpected costs related to it. Accident insurance provides payments for specific types of injuries such as dislocations, burns, eye injuries, cuts requiring stitches, broken bones and more.

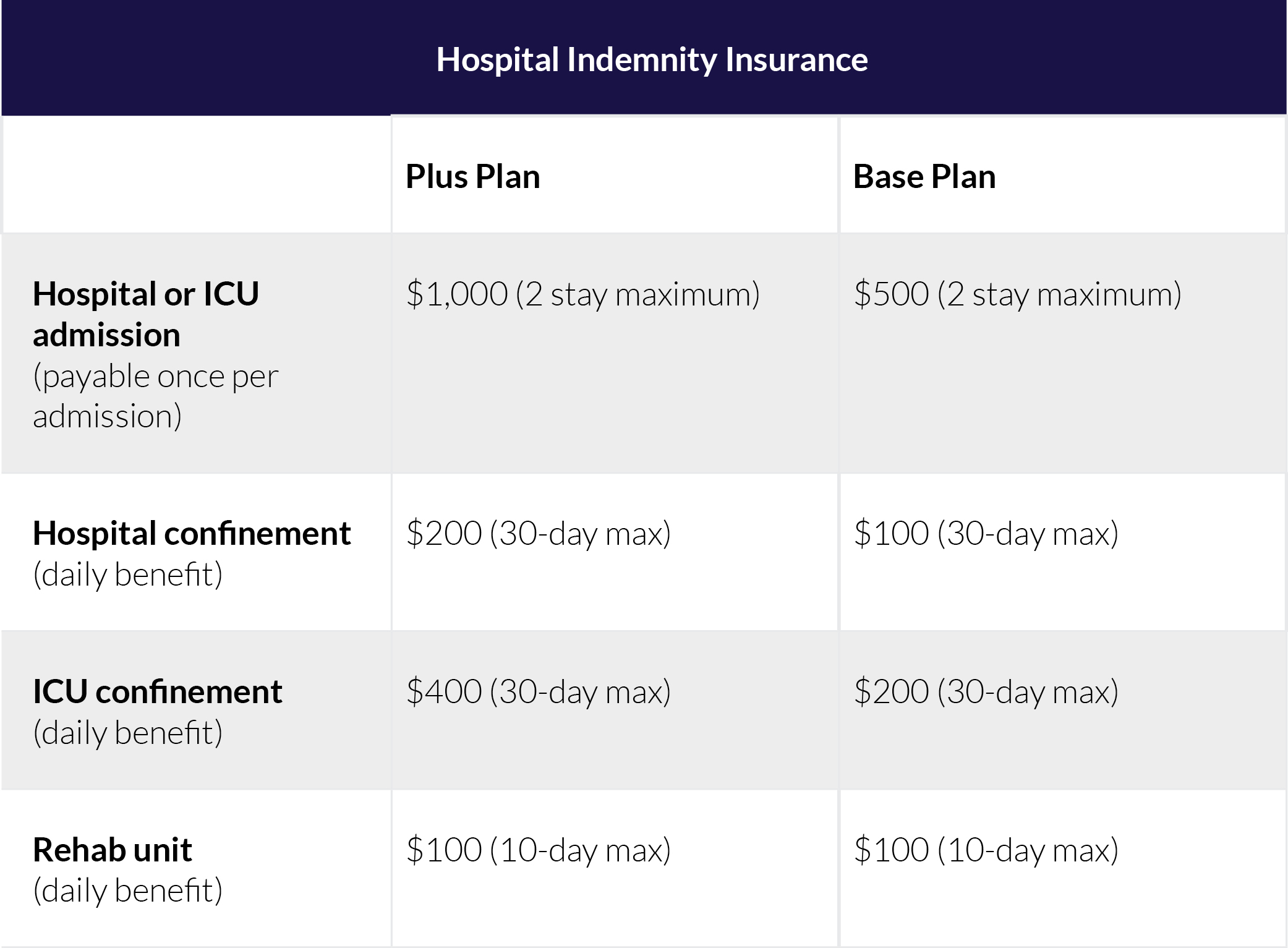

Hospital indemnity insurance

The hospital indemnity plan pays cash benefits directly to the member when they are admitted to the hospital for a covered inpatient stay, providing important financial assistance toward medical plan deductibles and coinsurance.

Critical Illness Coverage

Critical illness insurance can help protect your finances by paying cash benefits in the event you are diagnosed with a covered condition. These benefits can be used to pay for everyday expenses like mortgage payments, day care and other bills, or they can help you cover medical expenses such as coinsurance or deductibles.

Your policy* will provide protection for a variety of critical illnesses and diagnoses, including:

- Heart attack

- Stroke

- Coronary artery condition

- Major organ failure

- End-stage renal failure

- Paralysis

- Loss of sight (blindness)

- Loss of speech

- Loss of hearing

- Coma

- Benign brain tumor

- Third-degree burns

- Cancer (invasive)

- Bypass surgery — 50% benefit

- Alzheimer’s disease — 50% early stage / 100% advanced stage

- Parkinson’s disease — 50% early stage / 100% advanced stage

- Lupus — 30% benefit

- Multiple sclerosis — 50% early stage / 100% advanced stage

- Muscular dystrophy — 100% benefit

- Carcinoma in situ (non-invasive) — 30% benefit

- Skin cancer — $250

MyQHealth Care Coordinators are available to help you and your family get the most out of your benefits while simplifying the health care process.

Care Coordinators can:

- Serve as personal health care guides who get to know the unique health and wellness needs of members.

- Work with providers to ensure members receive high-quality, safe and cost-effective care.

- Understand Barnes benefits from top to bottom, so they can help with any questions.

Call 1-855-649-3862, Monday to Friday, 8:30 a.m. to 10:00 p.m. ET

Visit my http://mybgibenefitscenter.com/

Download the MyQHealth mobile app

We’re excited to offer employees the Bank of America Employee Banking and Investing (EB&I) Program. From just starting out to managing complex needs, this award-winning benefit can support your financial journey.

The EB&I program offers:

- Digital tools to make it easy to manage finances.

- Financial wellness education (in person or online).

- Investment guidance from Merrill, the investment division of Bank of America.

- Access to Preferred Rewards Gold Tier benefits, such as credit card bonuses, reduced banking fees, discounts on interest rates and fees for auto loans and mortgages, and more.

Be sure to watch for more information on this new wellbeing benefit later this fall, including communications on how to enroll.

This is an exclusive benefit being offered to our employees as negotiated by Apollo on behalf of its U.S. Portfolio Companies.

A change to 401(k) Catch up Contributions

If you’re age 50 or older and earned $145,000 or more from Barnes in 2025, a new IRS rule may affect how your catch-up contributions are taxed.

Starting January 1, 2026, a new federal rule says that:

If you earned $145,000 or more in pay from Barnes in 2025, then any catch-up contributions you make in 2026 must be made as Roth contributions.

This means those contributions will be made after taxes are withheld; however, these contributions, including any earnings on these contributions, may be withdrawn tax-free in retirement (provided certain IRS rules have been satisfied).

Regular 401(k) contributions are not affected — only the extra catch-up contributions for employees age 50+ are impacted.

Watch for more information on this plan change later this fall, including any steps you may need to take if you are affected.

Coming Soon! Personalized 401(k) Support with Managed Account Services

We’re excited to introduce managed account services as a new feature in your 401(k) plan –designed to help you make smarter retirement investment decisions.

A managed account offers professional investment management tailored to your unique financial situation. Your portfolio is regularly adjusted based on factors like your age, salary, savings rate and retirement goals – so your investments stay aligned with your personal needs.

This service may be especially helpful if you:

- Prefer a hands-off approach to investing

- Want help navigating market changes

- Are unsure how to choose or adjust your investments over time

Participation is completely voluntary, and additional fees will apply only if you choose to enroll.

Be on the lookout for more information regarding this new service in our year-end 401(k) communication.